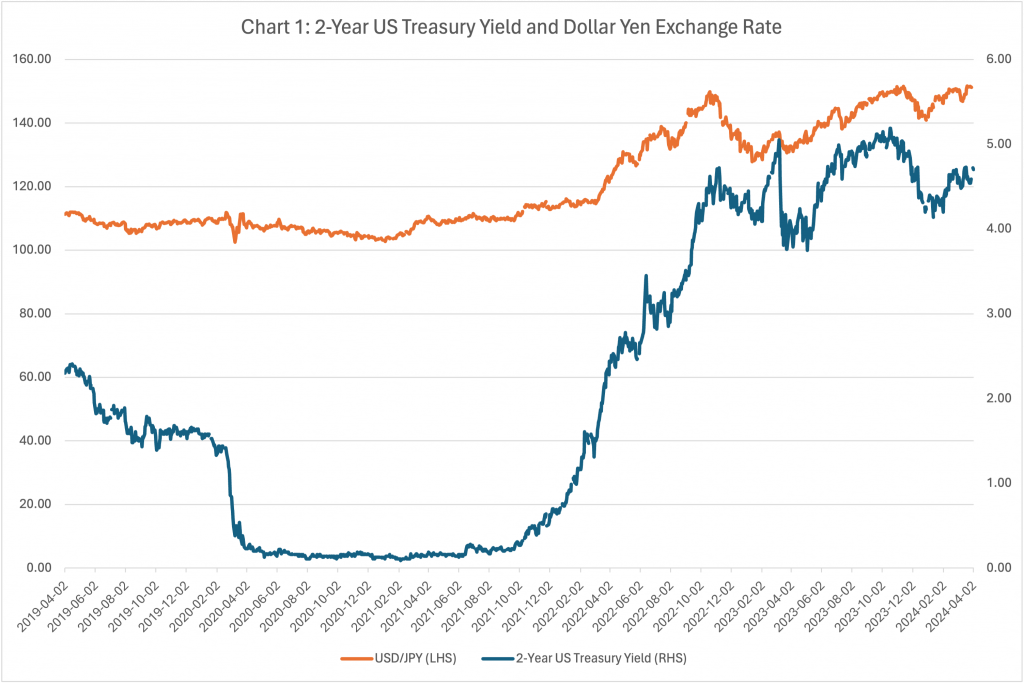

Yen has depreciated by 32% over the past 2 years. As dollar/yen strengthens to over 150, a level unseen since 1990, we are betting on Yen to recover to 110 levela as US Treasury Yields move lower.

As Chart 1 illustrates, USD/JPY has moved closely with 2-year US Treasury Yield over the past five years. Theoretically, as US yields lower, the USD bond held by Bank of Japan will move higher and Bank of Japan will be forced to sell the USD bond and eventually USD to rebalance their higher USD-portfolio,. The continuous sale of USD as US yields move lower will triger a weakening of Dollar-Yen and USD/JPY will move back to 110.

To summarize, US Fed rate cuts in coming months and year will end the long JPY depreciation and push JPY to the last support level 2 years ago.