To assess US equity direction before rate cut, we must first decide or forecast the next rate cut. In this regard, our house forecast that there will be no rate cut during 2024, as core PCE inflation treading at high 2%, above the Fed’s target.

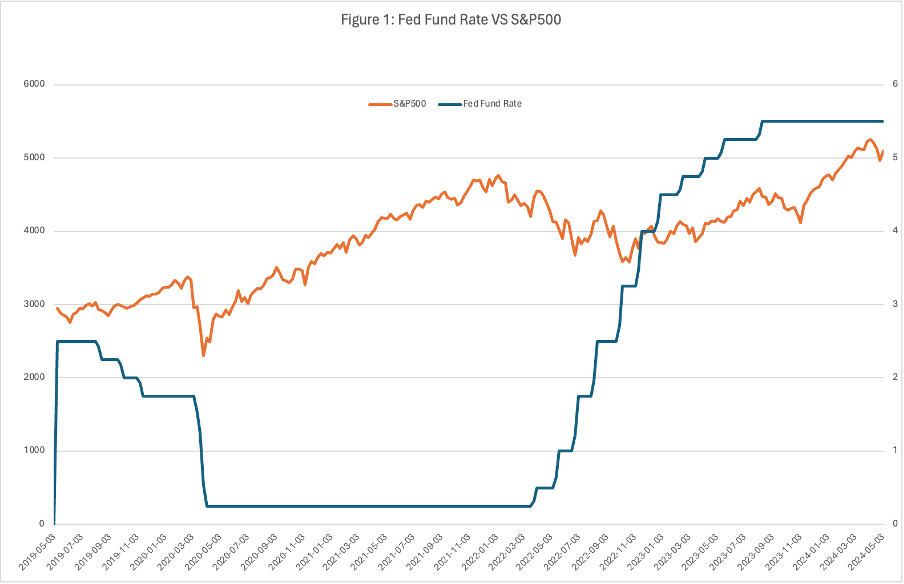

5-year relationship between Fed Fund Rate and S&P500 is ambivalent (Figure 1).

We believe US stocks, after hitting all-time high in March is due a 10% correction from that all-time high, while Fed Fund Rate is kept constant. Rate cuts seem to be an essential condition for S&P500 to challenge the all-time high in March. But rate cuts will not come easy as the labor market is bullish and inflation still comes off a tad higher than the Fed target.