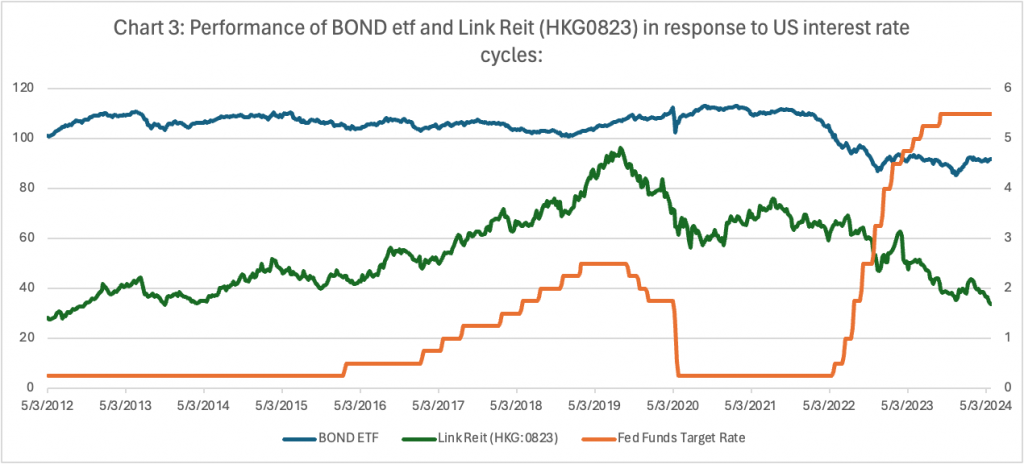

Chart 1: Fed Target Interest Rate Probabilities from Fed Fund Futures

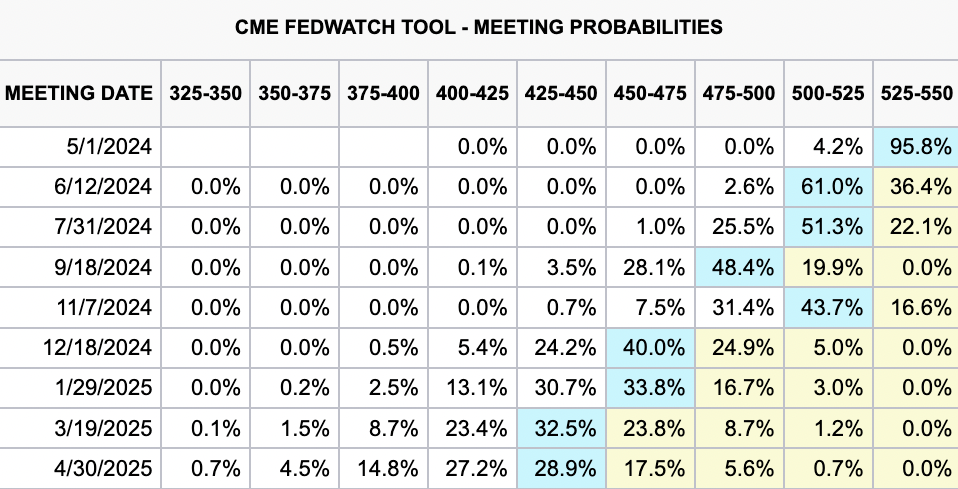

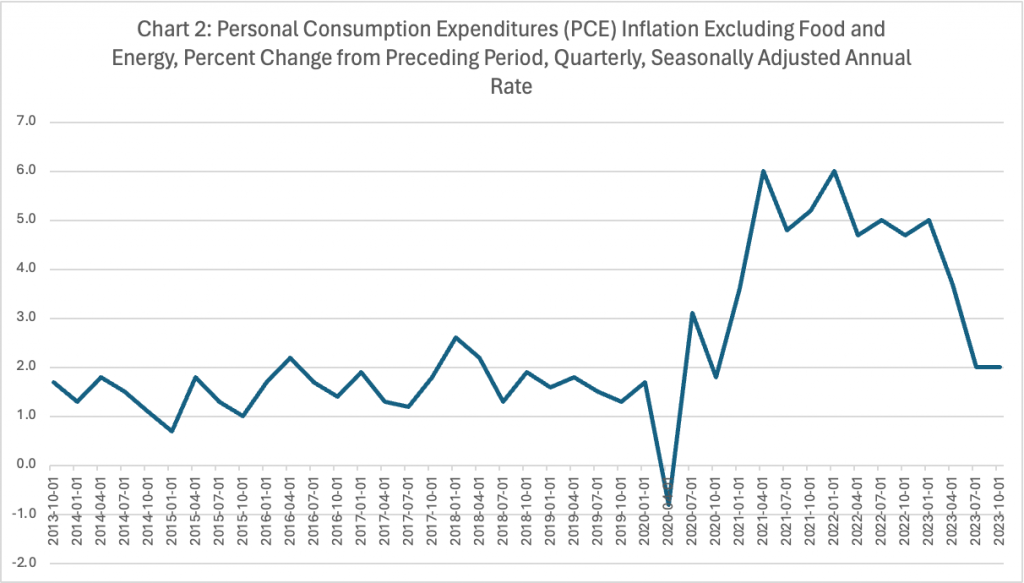

As the futures market is pricing in three rate cuts (40% probability) by end-2024 and as the Fed’s preferred gauge of inflation––– PCE inflation comes back to the Fed’s target of 2%, we are preparing for the suitable investment strategy to cope with coming rate cut cycle.

We choose Link Reit (HKG0823) and PIMCO Active Bond Exchange-Traded Fund (NYSE:BOND) as these two instruments have a reverse relationship to interest rate.